When it comes to movies, you’ve got to spend money to make money. At least that’s the takeaway from a recent study, “Economics of Motion Pictures,” conducted by the research firm SNL Kagan.

Films that cost more than $90 million to make generally produce the greatest profit, the report found.

“Economics of Motion Pictures” analyzes all films released on 1,000 or more screens from 2004 to 2008 and provides a 12-year financial model based on genre and budget.

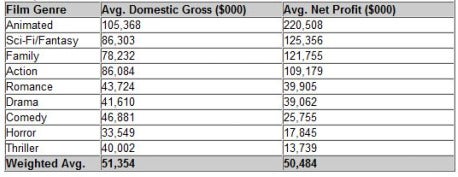

SNL Kagan found that the 83 films with budgets greater than $100 million averaged $247.3 million in net profit under a major-studio distribution fee structure, followed by those in the $90 million-$100 million range with a $117.9 million average net profit. The 764 films in the study averaged $50.5 million in net profit.

"It’s alwasy interesting that these mid-range budget films tend to not produce big numbers," SNL Kagan analyst Wade Holden told TheWrap. "Films that cost $50 million or $40 million are somehow riskier than an $100 million film That’s probably because these days movies with huge budgets are the big summer spectacles like ‘Iron Man’ or ‘The Dark Knight.’ They’re filled with special effects, so audiences say that’s worth the $10 or $15, whatever I’m shilling out to see a spectacle versus a drama or comedy."

Holden has run similar studies five times. He said low-budget films still can have a wide profit margin if they target a specific audience.

The study also found that the movie industry has benefited from recession-wary audiences looking for a diversion from the current economic troubles. Through Aug. 9 of this year, admissions were up 5.1% to 938.0 million and total domestic gross rose 7.3% to $6.88 billion.

However, there were some dark clouds for the industry. Declining DVD sales are endangering studios’ largest revenue source. Sell-through revenue fell 6.8% in 2008 to $14.84 billion.

“Consumers are increasingly turning to Redbox’s $1 kiosk rentals and Netflix’s all-you-can-watch DVD and streaming services,” Holden said. “Going forward, we expect the sell-through industry will continue to decline despite growth in high-definition. We estimate video sell-through revenue will drop 13% to $12.86 billion in 2009 as VOD technologies begin to erode market share.”